DO IWC WATCHES HOLD THEIR

VALUE? | VINTAGE GOLD WATCHES

It is said that owning a vintage IWC is something everyone with a serious interest in vintage watches should aspire to. A strong statement perhaps, but a little time spent researching IWC and specifically their 1950s and 60s watches, will very likely lead one to the same conclusion.

In essence, this is because during the 50s and 60s, IWC decided to manufacture some of the very best watches ever made, and this is exactly what they achieved. The craftsmanship, technical excellence and sheer beauty of their exquisite movements and cases, manufactured during the ‘golden age’ of watch-making, have never been beaten.

Provenance of IWC

Founded in 1868 by American Florentine Ariosto Jones, IWC’s heritage is deeply rooted in American pioneering spirit and entrepreneurship. The ambitious businessman travelled to Switzerland and set up his own factory with the intent of combining American production technologies with Swiss watchmaking skills to create high-quality timepieces for the American market.

Due to high import tariffs to the U.S, the company ran into financial hardship early on and was taken over by the Rauschenbachs, an industrialist family from Schaffhausen, Switzerland in 1880, and changed hands several times over the coming decades.

Even with its shaky beginnings, it was clear from the start that IWC was a highly innovative company dedicated to excellence. IWC created the first watch with a digital display of hours and minutes back in 1885. And went on to invent numerous industry-changing technologies, such as the Pellaton winding system in 1950 which has remained a central feature of IWC’s automatic movements to this day.

Other significant innovations include the infamous titanium and ceramic Pilot tool watch created for the aviation industry in 1936. The Aquatimer watch was created for scuba divers in 1966 (initially waterproof to 200m, and later becoming waterproof to 2,000m, along with the Ocean 2000 model). The Da Vinci can be accurate for 122 years. The Grand Complication watch launched in 1990 is, as you would expect, the most complicated timepiece of its kind – containing 659 parts.

These are just a few of the most memorable engineering feats that have been brought to the world by IWC. It’s clear that the company’s technical prowess and ingenuity is unmatched. But do IWC watches hold their value? And are there any nuances to IWC vintage watch investments?

Do IWC watches hold their value?

Of course, there are always exceptions to every rule but generally speaking IWC watches hold their value very well. IWC make some of the best watch movements in the industry. Their hand wound and mechanical movements are of the highest quality, along with their classic design, rich historical provenance and solid design innovations make them highly sought-after. Meaning you could do a lot worse than invest in a vintage IWC.

There’s a general rule of thumb to be considered for the depreciation and appreciation of luxury watch models that should be understood before investing. There is an industry-recognised depreciation curve on all new watches that typically last for 20 years or more before a watch will start to appreciate.

So, if you buy a new IWC, or any other new luxury brand watch for that matter, expect the watch to depreciate for 20 years or more (up to 40% of its retail value for most watch brands) before it starts to appreciate. Still, on average, an IWC watch will either hold its retail value, depreciate only slightly (much less than the market average – possibly 5 to 10%), or appreciate during its first 20 – 30 years.

But there are nuances here and it depends on the model and era it was manufactured. That being said, IWC has a very good track record of holding its initial sale value even in those formative decades of standard industry depreciation.

Needless to say, buying a vintage IWC watch, or any vintage watch, means that the watch has gotten over its depreciation curve, and should hold its value and begin to appreciate. Another good reason to buy vintage.

Why do IWC watches hold their value?

There are several market-driven factors that affect IWC watches’ ability to hold their value. It is important to clarify that by ‘holding value’ we mean that it holds its initial retail value and does not depreciate.

The first and foremost reason is the limited supply of watches which drives the value up. It’s reported that IWC produces in the region of 70,000 – 120,000 watches each year, although, like most luxury watchmakers, IWC has never clarified its production numbers. This is perhaps one of the main reasons that it is not unusual to see IWCs sell for more than their recommended retail value, even during the standard depreciation curve years.

Another reason IWC watches hold their value is simply down to their superb and accurate movements, exceptional design and manufacture, and high-quality materials (platinum, titanium and 18-karat gold are commonly used). Also, the parts for IWC watches are readily available worldwide making them very easy to work on and maintain. These are all reasons why IWC watches keep their value and are a solid buy for anyone who is looking for a high-quality investment piece.

Examples of IWC models that hold their value exceptionally well are:

- Da Vinci

- Pilot

- Ingenieur

- Aquatimer

Which vintage IWC watches depreciate in value?

With the above being said, it is important to reiterate that not every IWC watch is guaranteed to hold its value or appreciate over time. The IWC Portofino and Portugieser are cases in point. The Portofino is more likely to follow the standard industry depreciation curve in the first 20 years. Even though the watch was both released and discontinued in 2008, meaning that the supply of IWC Portofino watches can’t possibly be that large to warrant such a decline in value.

It all depends on how sought-after a particular watch is. That’s why old and vintage watches hold such high prices. It’s economics 101; the price skyrockets when the supply is low and the demand is high and vice versa. So, these specific examples of IWC watches that follow the depreciation curve will only be valid if you are purchasing a brand new IWC watch, and will never be seen in a vintage IWC watch which has already been through its potential depreciation years.

Does that make them a good investment?

Of course, no investment is guaranteed. But if you’re looking for a high-quality watch that will hold its value over time, IWC is worth considering. I believe that a vintage IWC Pilot or Da Vinci makes an excellent investment for anyone looking for a high-quality luxury vintage watch that will continue to be appreciated.

With proper care, an IWC watch can last for decades, if not longer, and its value will likely continue to increase over time. Of course, there are no guarantees when it comes to investing in watches. But for those looking for a safe bet, IWC is an excellent option to consider.

Which IWC watch should I invest in?

Within the vintage watch market, the general rule of thumb is the more you spend on a watch the less likely you are to lose money on it – as it is established as highly recognised and coveted with aspirational elements that many people want to own. However, you don’t have to remortgage your home in order to make a good investment with IWC vintage watches.

If you are looking for a vintage IWC as an investment that doesn’t break the bank and is likely to gain value, we recommend considering these models:

IWC Perpetual Calender/Perpetual Date

With a date set function and the ability to take into account leap years. They are robust enough for daily wear and are highly complicated watches that hold their value well. This is a special example currently for sale which has the addition of a chronograph function known as the Da-Vinci model Ref. 3750. This is a fantastic example of watchmaking at its finest and is of incredible value compared with an equivalent Patek Philippe, which is significantly more expensive.

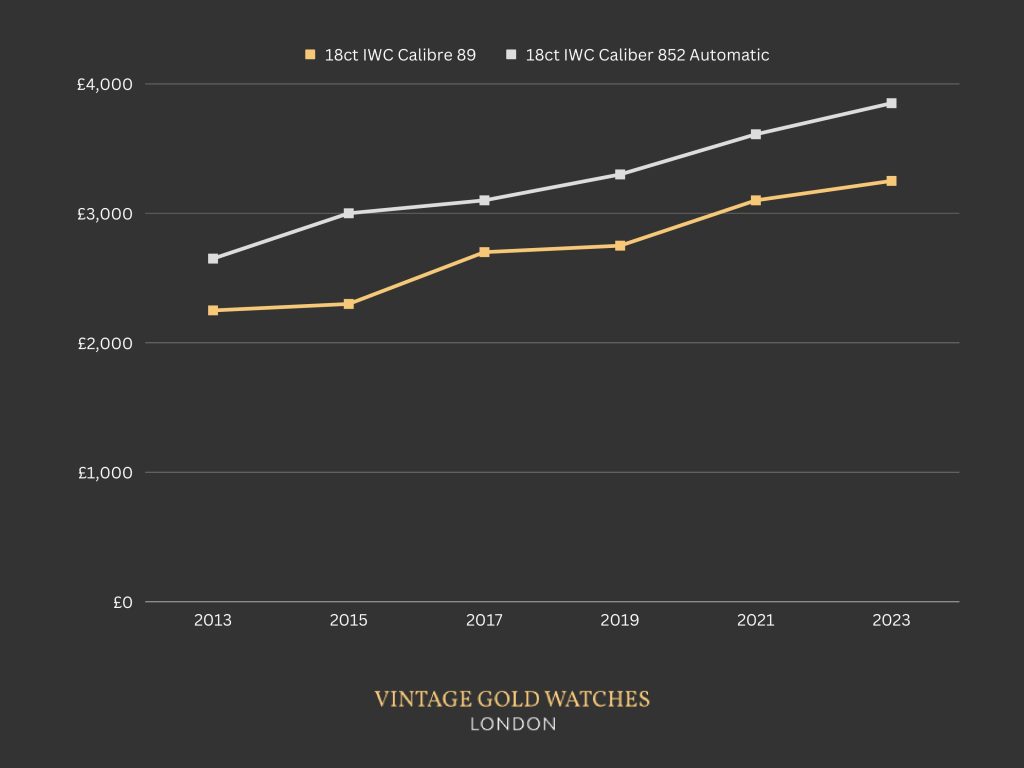

Calibre 852 and 853 and 854 (series) Automatic

These IWC automatic watches are solid investments because they are considered to be some of the best automatic movements ever made and therefore are highly respected and sought after. Look out for any Calibre reference with 852XX types.

Here are some current examples for sale on our website:

IWC Automatic Date Cal.8521 18ct 1954

£3,250

IWC Cal.853 Automatic 9ct 1960

£3,350

IWC Automatic Cal.8541 9ct 1968

£2,950

Calibre 89 hand-wound movement

The watch on which IWC has built its name. Initially produced for the military and used by them continuously for over 30 years, it became ‘the standard’ for military-grade timepieces. The movement also came to be an IWC mainstay in the commercial market, remaining in production until the mid-1990s.

Here are some examples of Calibre 89 hand-wound movements currently for sale in our shop:

£3,500

IWC Cal.89 18ct 1948 / 1950 37mm Original Box & Papers

£4,000

IWC Cal.89 18ct 1951 Bullhorn Lugs

£3,600

Be the first to view our new stock and get the latest vintage watch news straight into your inbox by signing up for our weekly newsletter.